If you’re someone who heads south for the winter or splits your time between two homes in different states, you’re what the world often calls a “snowbird.”

While your dual-state lifestyle might offer the best of both worlds, it can also make your Medicare coverage a little more complicated.

Here in the Sierra Foothills, we know how quickly the seasons change — one minute you’re enjoying crisp mountain air and cozy nights by the fireplace, and the next you’re packing for sunnier skies. Whether you’re escaping the Foothill chill or returning home in spring, it’s important to make sure your Medicare plan can travel with you.

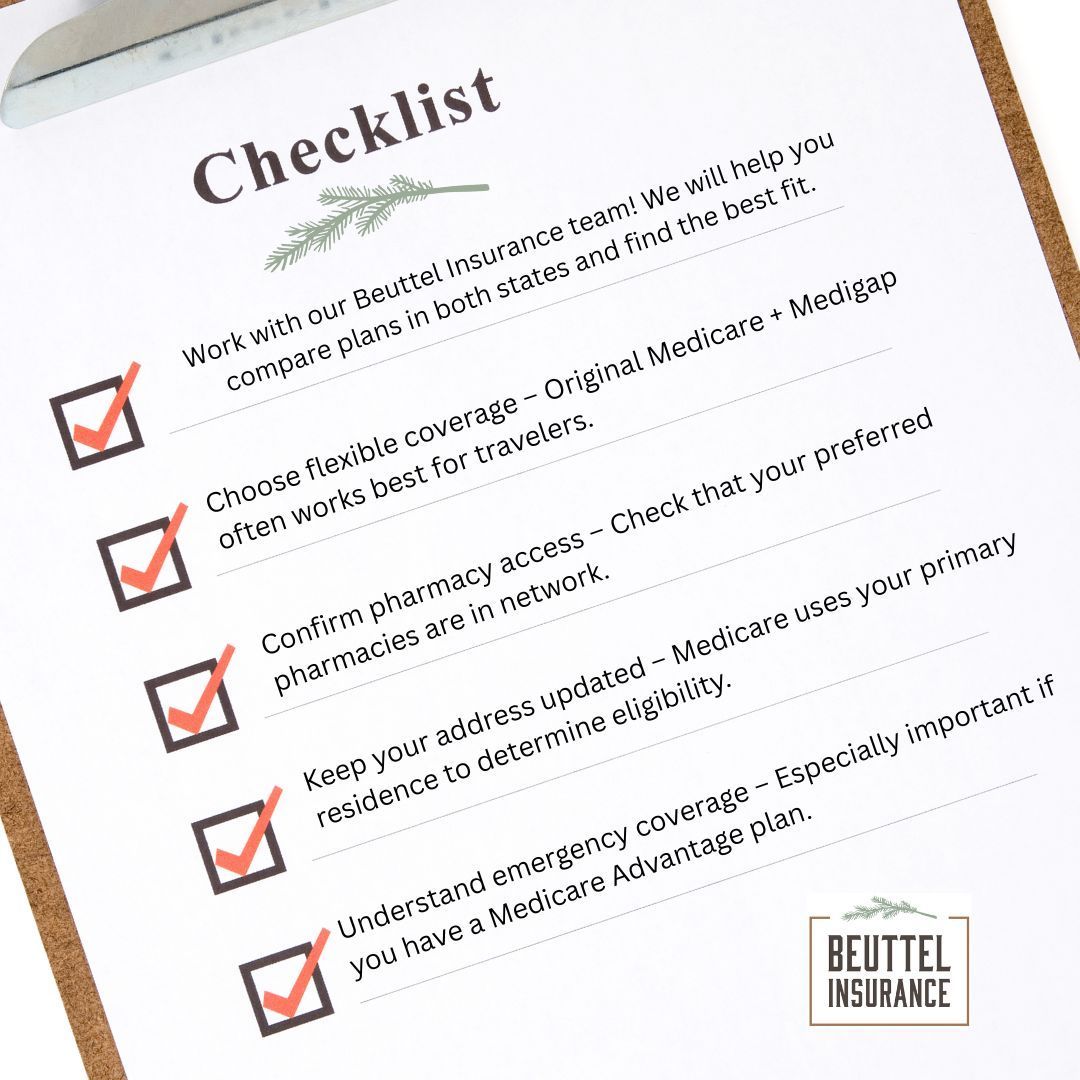

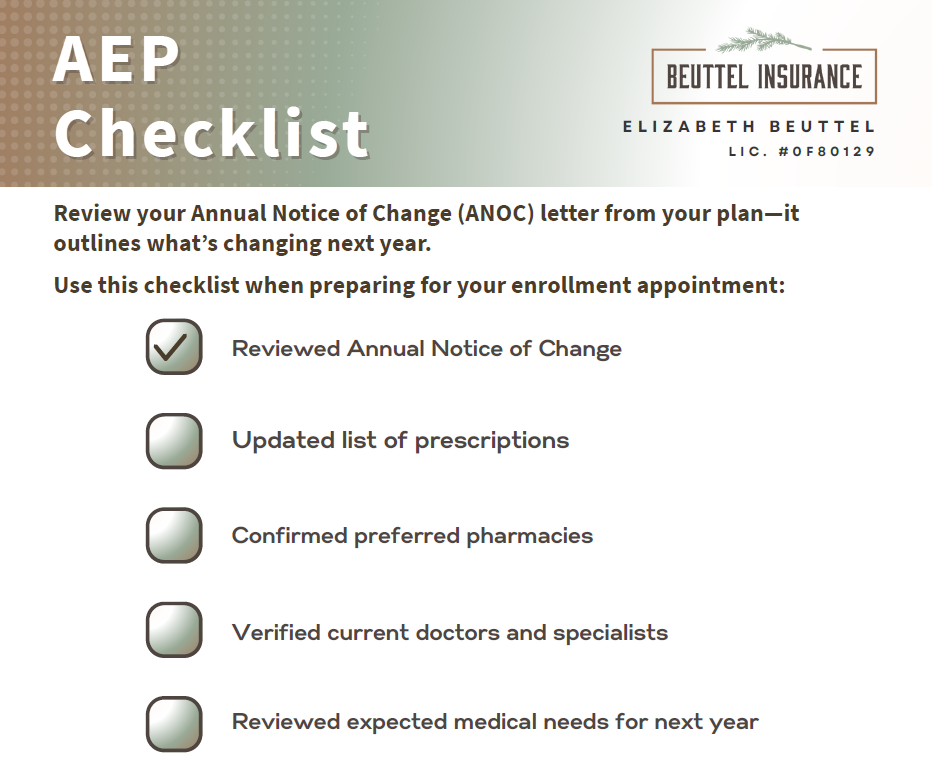

The good news? With a little planning, you can make sure your benefits stay as flexible as your lifestyle.