Another Year of Changes in the Medicare Industry: What You Need to Know and How to Prepare Before AEP

2026 Brings More Medicare Changes: Here's What You Need to Know.

Key Takeaways

- 2026 changes coming: Be prepared during this year’s AEP.

- AEP runs October 15 – December 7, 2025 for coverage effective in 2026.

- Parts A & B costs expected to rise, so budget adjustments may be needed. Part B jumping 11%. to $206 a month in 2026.

- Some Medicare Advantage plans are ending or changing, making it important to review your options.

- Why Work With Us: We are your local trusted advisors, we will assess your needs to help you make confident decisions for your coverage needs.

What’s Coming in 2026

With the Medicare Annual Enrollment Period (AEP) approaching on October 15, it’s important to be prepared for 2026. The Centers for Medicare & Medicaid Services (CMS) has announced several updates that could affect your coverage, including changes to prescription drug costs, premiums, and plan options.

Here are a few key updates for 2026:

- A new cap on prescription drug costs: The maximum out-of-pocket spending on covered Part D drugs will be capped at $2,100, up from $2,000 in 2025. This gives greater financial predictability if you have high drug costs.

- Drug price negotiations: For the first time, negotiated prices for some of Medicare’s most expensive drugs will take effect. Download the updated 2026 Part D drug list. Click here to review the full 2026 Medicare Drug Price Negotiation Program guide.

- Higher costs projected for Parts A and B: Premiums and deductibles for Original Medicare (Parts A and B) are expected to increase. Medicare Part B premiums are jumping

11% to $206 per month in 2026.

- Review your plan: Some Medicare Advantage plans are adjusting benefits, and some carriers may be exiting certain markets. If your plan is affected, you will need to choose a new one during AEP.

Why review your plan now?

Even if you’re happy with your current coverage, it’s crucial to review your options every year. Your plan’s benefits, premiums, and drug coverage can change—and your own health needs may have evolved.

Major Changes Are Already Underway

Many Medicare Advantage Plans are already exiting in 2025. This means you may need to transition to a new plan to maintain the coverage that fits your needs.

Medicare’s Annual Election Period (AEP), running October 15 through December 7, 2025, is your chance to review your options and make changes that will take effect in 2026.

If you are new to Beuttel Insurance, please contact our office at 530-303-3366 to schedule your complementary benefits review appointment.

If you’ve received a call or letter from your carrier about your plan ending—don’t stress. That’s why we’re here. We’re ready to guide you to a plan that supports your health, meets your financial needs, and gives you peace of mind.

What to Review Before AEP

To stay ahead, here are the key things you’ll want to review before enrollment begins:

- Review your Annual Notice of Change (ANOC): This document, usually arriving early September, outlines what’s changing in your current plan for 2026, including premiums, benefits, and provider networks.

- Check if your plan is ending: Some Medicare Advantage plans will not be available in 2026. Knowing this early helps you plan ahead.

- Know your rights and options: If your plan is being discontinued, you’ll have special opportunities to choose a new plan without losing coverage.

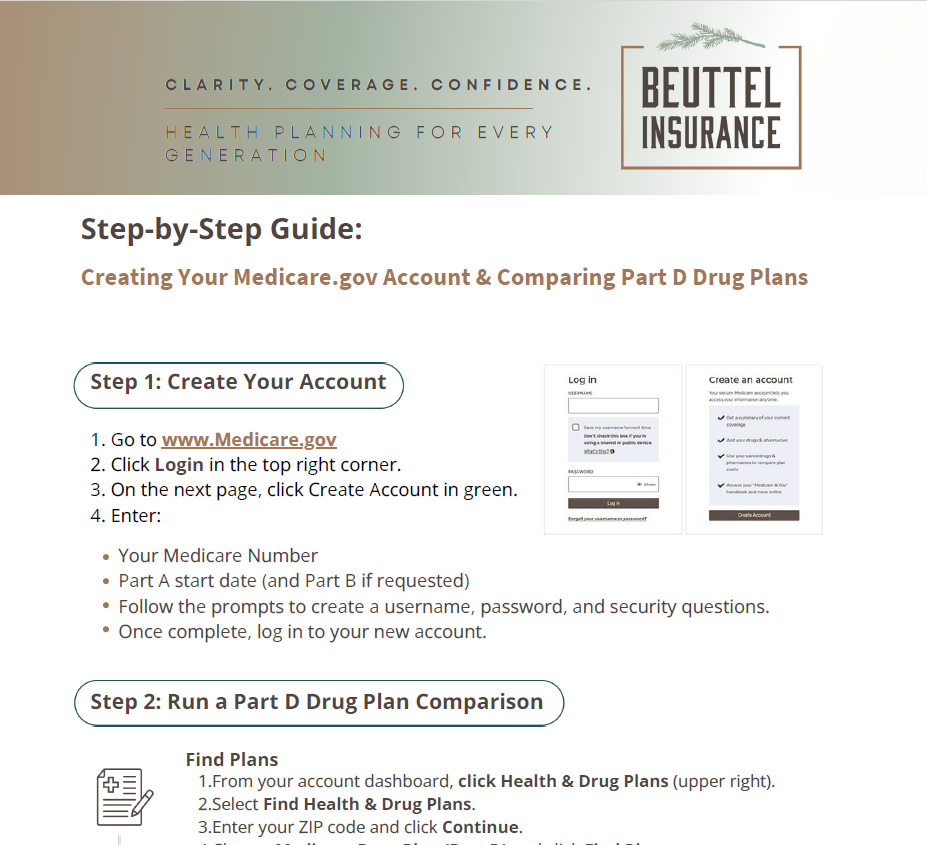

Start your AEP prep today by downloading our

AEP Checklist!

Why Work With Us?

Choosing a Medicare plan can feel overwhelming, especially with so many changes happening this year. That’s where we come in. We are your local trusted advisors, we will assess your needs to help you make confident decisions for your coverage needs.

Here’s what we can help you review when comparing plans:

- Rates and costs: Making sure the premium and out-of-pocket expenses fit within your budget.

- Plan stability: Looking at how plans have changed over time so you can feel confident about the coverage you choose.

- Coverage value:

Ensuring the benefits align with your healthcare needs—not just today, but in the long run.

The lowest-cost plan isn’t always the best option. By working together, we’ll look at the full picture so you can make a confident choice that balances cost, coverage, and peace of mind.

Let’s Get Started Together

Medicare changes can be very confusing and even stressful, but you don’t have to face them alone. We’re here to answer your questions, review your options, and guide you into a plan that’s beneficial for your health, meets your budget, and gives you peace of mind.

If you are new to Beuttel Insurance, please contact our office

530-303-3366 for a complementary benefits review appointment.